Latest Photo Galleries

Brazilian Markets

17h36 Bovespa |

-0,07% | 124.646 |

16h43 Gold |

0,00% | 117 |

17h00 Dollar |

+0,29% | 5,1640 |

16h30 Euro |

+0,49% | 2,65250 |

ADVERTISING

Inflation in Brazil Declines and Central Bank Decides to Slash Tax Rates

01/12/2017 - 12h16

Advertising

MAELI PRADO

FROM BRASÍLIA

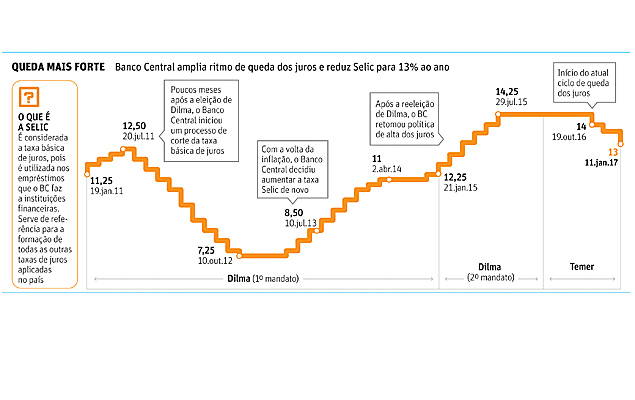

The Monetary Policy Committee of Brazil's Central Bank decided to reduce the benchmark tax rates of the Brazilian economy (Selic) by 0.75 percent to 13 percent a year.

The higher cut surprised the market and declines are likely to continue in the following months.

The Committee said that the economic activities below expected and the widespread reduction of inflation provided the appropriate scenario for a more significant tax reduction. The Selic is a reference for tax rates used by banks.

After the announcement, the IBGE (Brazilian Institute of Geography and Statistics) disclosed that the official inflation in Brazil at the end of 2016 stayed within the limits previously set by the Government.

| Editoria de Arte/Folhapress | ||

|

||

| The higher cut surprised the market and declines are likely to continue in the following months. |

The country's official inflation was 6.29% last year. It was the first time since 2014 that inflation was below the target of 4.5% per year with a tolerance of up to 6.5%.

In the last months of 2016, the Central Bank had already made two 0.25 percent cuts in the benchmark interest rate.

Economists now forecast that the Selic will end 2017 with a single digit.

Translated by THOMAS MUELLO